Tesla cut prices on most of its car modelslast week, in some cases by as much as 20%. Reaction to this price cut has been mixed, with many investors seeing the move as a sign of weak demand for its cars. This is despite the same investors complaining that Tesla had raised prices too much last year during the supply chain shortage.

I see this move differently. I think that Tesla cut prices because it makes money on its cars and its competitors don’t.

Think about the capital investments Tesla has made over the past 3 years:

3 new Gigafactories (Texas, Berlin, Shanghai) to boost production volumes

New Gigapresses for body casting, allowing car bodies to be pressed in one operation instead of assembled from a host of individual parts.

Structural batteries, which make the car stronger while reducing parts cost.

Add to this the fact that Tesla has the largest cash flow per car of any car company and the highest margins, and the obvious question becomes:

What can Tesla do with all its money?

The recent price cut is the answer.

By reducing prices across the board, Tesla achieves several strategic goals. These price cuts:

Open up a wider audience for its cars. Demand for Teslas has always exceeded supply throughout its lifetime, despite it not spending any money on advertising. While we’ve seen Tesla’s backlog diminish recently, every car it makes only satisfies that backlog; it doesn’t generate new sales. So unlike what most of the press has been saying, the price cuts likely will have little or no effect on the actual number of cars sold and shipped. What will change is that the Tesla will now reach buyers beyond its traditional luxury car market, which will help expand its brand appeal over the long term.

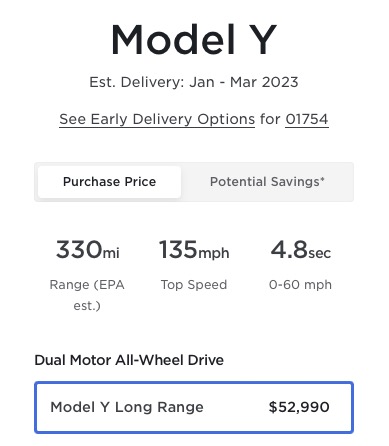

Allow some models to qualify for the new US tax incentives. Tesla had been locked out of US tax incentives since early 2020 because the tax rebate was limited to manufacturers who had sold fewer than 200,000 EVs. However, the new US Inflation Reduction Act allows cars costing less than $55,000 and SUVs costing less than $80,000 to get the new $7,500 rebate, regardless of production levels. This means that some Tesla Model 3s and Model Ys will now achieve a net price to the consumer that is $7,500 less in addition to the new price cuts.

Squeeze other manufacturers between a competitive rock and a profitability hard place. According to a study done by McKinzey & Company, despite all their promotion of new electric vehicles to compete with their internal combustion engine cars and trucks, most OEMs don’t make a profit on EVs at current price levels. Tesla’s price cuts on its vehicles leave competitors with two choices: lose market share to Tesla based on price or cut prices and lose even more money per vehicle than they already do.

Tesla could have left its prices where they were in 2022 and added more cash to its already bulging $20+ billion cash hoard. Instead, it decided to push EV prices down, expand its market, and make 2023 that much more uncomfortable for its competitors. That’s not weakness; it’s strength.